A guide to calculating the income requirements to sponsor your parents and grandparents for Canadian immigration.

When you apply to sponsor your parents or grandparents for Canadian immigration, you have to prove that you have made enough money to meet the income requirement. The income requirement varies for Parents and Grandparents Program (PGP) applicants, depending on the size of your family, the number of people being sponsored, and whether you are sponsoring your family members in Quebec or another Canadian province.

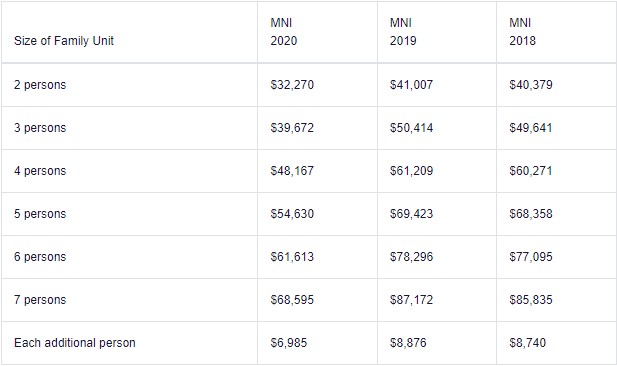

Minimum Necessary Income for PGP sponsorship outside Quebec

IRCC looks at your income for the three consecutive taxation years before you apply. For this year, that means your annual income from 2018, 2019, and 2020.

The Minimum Necessary Income (MNI) applies to you, the sponsor, not your parents and grandparents. If you cannot meet the income requirements, you can include your spouse or common-law partner as a co-signer to help meet the requirements of the undertaking.

The MNI for each year is typically calculated based on IRCC’s Low Income Cut-Off (LICO) figures plus 30 per cent. The MNI for 2020 due to the economic challenges that many Canadians faced during the pandemic.

If your family added or lost a member within in these years, then the MNI will apply to the number of persons in the household for that year. For example, if you and your spouse had your first baby in 2019, you would then have to meet the MNI requirements for a family unit of three for 2019 and 2020.

In order to prove your income for these years, you need to provide your Notice of Assessment from the Canada Revenue Agency for each of the three taxation years.

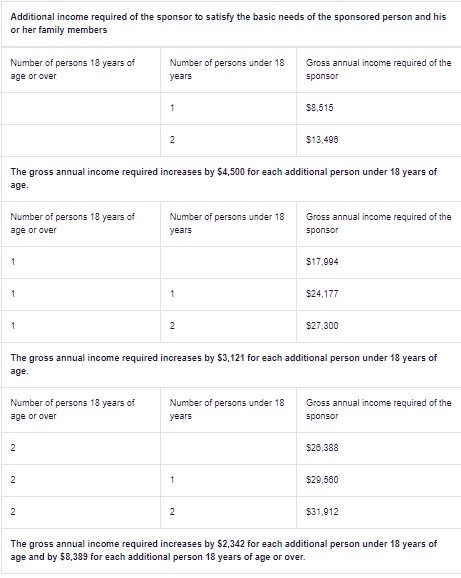

Income requirements for PGP sponsorship in Quebec

If you are living in Quebec, you will have different income requirements. This is because Quebec has more autonomy over its immigration system compared to other provinces, even if IRCC gets the final say on permanent residency status.

The following amounts are required of those applying for the PGP 2021. In order to be eligible, you need to have made the following amounts in the 12 months prior to your application:

Rules about co-signers

If you are having trouble meeting the income requirements on your own, you may be able to list your spouse or common-law partner as a co-signer. Common-law partners will have to submit a form to confirm common-law status along with the PGP application.

Regardless of how long you have been together, IRCC will look at the co-signer’s income for the past three years if they are from outside Quebec, and for the past 12 months for Quebec residents.

The co-signer must also meet the same eligibility requirements as you, the sponsor, and agree to financially take care of your sponsored parent or grandparent for a period of time. They have to be at least 18, living in Canada as a Canadian citizen, permanent resident, or person with Indian status, among other criteria.

If you fall short of your financial obligations, you and your co-signer will be held equally liable.